Revisiting “Who Can Afford Housing in Bend?”

by Damon Runberg Regional Economist Crook, Deschutes, Jefferson, Klamath, and Lake counties damon.m.runberg@oregon.gov (541) 706-0779

Several years ago I produced some analysis that calculated who can afford housing in Bend. The relatively high cost of living even back in 2016 was leading many within the community to worry that meaningful contributors to our local workforce were being priced out of the local housing market. That early analysis showed that many professionals earning well above the median wage would have a difficult time purchasing the median home. It also revealed that many households must rely on multiple incomes to afford housing. Fast forward to 2021. Depending on where you look home prices have risen about 15% to17% over the past 12 months. It feels like it is time to revisit the question: Who can afford housing in Bend?

A major variable that impacts housing affordability is the cost of borrowing, or interest rates. Most of us do not have enough cash on hand to buy a home, particularly those of us concerned about affordability. Each 1 percentage point drop in your interest rate on a 30-year fixed rate mortgage overcomes a 10% increase in home prices. In 2020 interest rate declines largely negated the home price appreciation; however, rates stopped falling in 2021 and are now very slowly ticking back up. Meanwhile, home prices continue to rise, leading to real declines in affordability.

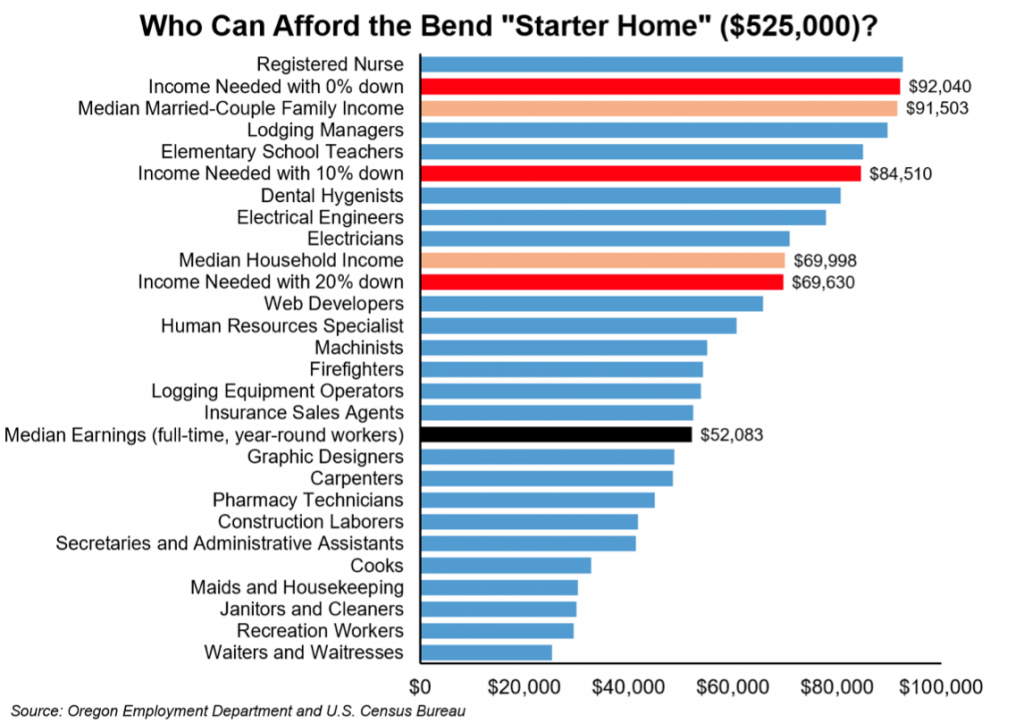

The first step of assessing who can afford housing is to pin down the cost of the house itself. I went with the median sale price over the past year, then rounded down a bit to $525,000 for our Bend “starter home”. This seems like a justifiable figure as the sales mode in March 2021 was in the $500,000 to $550,000 range and there were only 15 houses for sale in Bend at $500,000 or below that month.

Second step, we need to know how much that house will cost as a monthly mortgage. Using a 3% fixed mortgage rate and estimating taxes/ insurance I created three different scenarios based on the level of your down payment. If someone could scape together 20% ($105,000) then their monthly mortgage would be $2,320, but the mortgage would be closer to $3,070 with zero down.

Third step, what are the income needs to afford the mortgage on this Bend “starter home”? Before we know how much income you need to afford that mortgage we need to identify a normal or appropriate amount of your household income that would go towards housing. You cannot apply 100% of your wages to housing as that would leave no room for things like food, childcare, or other household expenses. The U.S. Department of Housing and Urban Development (HUD) defines households that spend between 30-50% of their income on housing as being cost burdened. At that level households begin having a difficult time affording other necessities. So I am using an income level that intentionally places the household into a cost burdened state to see who can afford housing when stretched as far as possible. With a 20% down payment you need a household income of around $70,000 to buy that Bend starter house if you are spending 40% of your income on housing. With a lower down payment you will need an annual income of $85,000 to $92,000.

Last step, how do those income requirements align with local wage earners and household incomes? The good news is the income requirements to buy the median house with 20% down aligns nearly perfectly with the current median household income. The problem is that very few of our median households have $105,000 for a down payment sitting around in the bank. At 10% down (still a very large down payment) the median household cannot afford this Bend “starter home”. I included a variety of occupational wages for context.

As you can see, most households must rely on multiple wage earners to afford housing in Bend. In fact, according to the U.S. Census Bureau, roughly 66% of the wage earning family households in Deschutes County have more than one wage earner. This analysis has focused exclusively on buying a home in Bend. However, if you are a renter then the household income needs are over $50,000, roughly equivalent to the median wage for all year-round, full-time workers. Housing has been and continues to be difficult to afford for many local wage earners in Bend. The more someone must spend on housing, the less they can spend on other necessities or more discretionary purchases. I won’t get into policy solutions or ideas, but it is important to understand that many hardworking households in our community face the very real question, can I afford to live here?

Advertisement