Review MUPTE Frequently Asked Questions June

What Is MUPTE?

How does it support multi-unit residential development?

How does the City determine if a housing project can receive a MUPTE?

Why should the City of Eugene support dense housing in the downtown core?

Can MUPTE support affordable housing?

Does MUPTE cause the City to reduce its tax revenue?

How effective has MUPTE been?

The rapid growth of Eugene since 2015 can be credited by a number of activities in the business and public communities of the area. City leadership has been very active in the recruitment of industry (look at the tech industry) and being ready to discuss new ideas for the success of entrepreneurs and their start-up ideas as well as established companies and leaders who are decades into the economic development of the area.

Reviewing one of the many creative ideas responsible for some of Eugene’s growth seems appropriate. Every idea, every idea for change, every divergent thought has its supporters and its opposition. MUPTE is an example of that kind of idea. Here is a Q&A of MUPTE for your review: Greg Henderson, Publisher Southern Oregon Business Journal

What Is MUPTE?

MUPTE is the Multi-Unit Property Tax Exemption. It is a state-enabled program designed to be an incentive of redevelopment of residential properties in city centers and along transit corridors. In Eugene, the City Council has authorized the use of MUPTE in the downtown area and west of the University. The program has been discontinued in the West University area and it has been narrowed so that student housing is no longer eligible.

MUPTE allows new multi-family units (5 or more units) to avoid property taxes on the value of new residential construction for up to 10 years. The property continues to pay taxes on the land value and any commercial portion of the property.

How does it support multi‐unit residential development?

The intent of MUPTE is to lower operating costs in the early years of a housing development so that it becomes financially feasible. In a housing market like Eugene, market rents are lower than in larger metropolitan areas, but the cost of construction is as high. The rents here make it difficult to build dense housing (that is, tall buildings) in the downtown core—taller buildings are more expensive to build than shorter buildings. New residential development does not ‘pencil out’, so new residences in the downtown core do not get built. It is more expensive to build downtown than on greenfield sites on the edge of town, because it is more complicated to build in an existing neighborhood where there is less elbow room. A high priority action item within the Eugene Climate and Energy Action Plan is to increase density around the urban core and along high-capacity transit corridors. National data show that individuals living in city centers drive, on average, fewer miles than individuals in other parts of a community. Downtown is walkable, has good access to transit, and offers goods and services for residents’ daily needs. More residents in the downtown will result in lower per capita carbon emissions and other automobile emissions (including carbon monoxide, nitrogen oxides, sulfur oxide, and particulate matter).

Housing in the downtown core also positively affects the economic activity in the city center. For example, new residents in the downtown support local businesses because they increase demand for nearby goods and services. Also, an occupied building creates an active use, which enhances the overall vibrancy of the downtown.

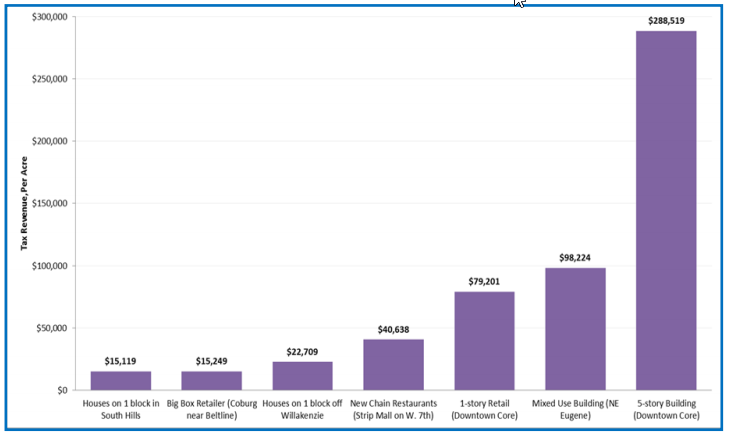

The chart below shows property tax per acre for a variety of development types and locations throughout the community. The chart shows that dense development in the downtown core generates substantially more tax revenue per acre than any other part of the city. And the dense development costs less to serve—the cost per resident for roads, water, and sewer are significantly lower.

Can MUPTE support affordable housing?

To understand if MUPTE would be a useful tool for affordable housing, one should understand how affordable housing is developed.

There are other tools the City of Eugene uses to construct affordable (subsidized) housing, including the LIRPTE (Low Income Rental Housing Property Tax Exemption) program. Like MUPTE, it offers a property tax exemption for the value of the new housing construction, but over a 20-year period.

Over the past several decades, the City has invested in thousands of units of affordable housing created through partnering agencies like St. Vincent DePaul, HACSA, and Cornerstone Housing. These units are only available to individuals and families typically earning less than 60% of area median income, and the below-market rents typically apply to 100% of the units.

There are currently 680 units of affordable housing in the downtown core area, and HACSA is proposing an additional 50 units. There are approximately 4,600 units of affordable housing throughout Eugene.

To compare MUPTE to existing affordable tools, consider a new apartment complex with 300 units. If 30% are rent-restricted, there will be 90 affordable units. They will maintain affordable rents for 10 years, creating 900 unit-years of affordable housing.

Compare that to a new affordable housing development with 90 units. Those units must maintain their affordable rents for 50 years, so the 50 new units would create 4,500 unit-years. Over the long term, existing affordable housing tools create many more units of affordable housing. Not only do the rents remain affordable for a 50-year period, residents typically receive support services related to job skills, employment opportunities, and health.

Does MUPTE cause the City to reduce its tax revenue?

The exemption has the ability to make a project financially feasible. If it is not financially feasible, it does not get built, so the City and other taxing jurisdictions never get the tax revenue. With the exemption, they get the tax revenue after 10 years. The exemption can make a housing financially feasible, and the City grows its tax base in the long term.

For example, the 50-unit Tate Condominium project used the MUPTE 9 years ago. When it comes onto tax rolls in 2016, it will generate approximately $262,000 in tax revenue. Without the new structure, the property would generate about $3,300 in tax revenue.

Because MUPTE encourages development is in the downtown core, the City is able to more efficiently provide services than in less dense parts of the community. Dense development requires less pavement, less sewer line, and less water line than in low density areas. The City generates more tax revenue per acre and spends less per acre.

Using the Tate Condominium as an example again, when it comes onto the tax rolls next year, it will generate approximately $300,000 per acre in annual property tax revenue. In comparison, an acre of single family housing generates about $20,000 per acre annually. Over a 20-year period, the Tate will generate more than 7.5 times the tax revenue per acre, when compared to single family development, even with a 10-year tax exemption.

There have been 28 residential projects that have received a MUPTE since 1978, creating 1,400 units. The private developers invested $283 million in those projects. The total combined tax revenue being generated on the 28 properties was approximately $133,000 per year before the projects were constructed. When all of these projects come onto the tax tolls, they will generate approximately $2.5 million per year in property tax revenue. The City did not have to invest any public resources (i.e., cash) to achieve this significant increase in tax revenue. In fact the private sector was responsible for the entire investment and took all of the investment risk. The City’s primary role was to sit patiently for 10 years waiting for the added value to come onto the tax rolls.

How effective has MUPTE been?

Since 1978, the program has supported the development of about 1,500 units in the city center. No new housing structures have been built in the downtown core without MUPTE or some other property tax exemption for at least two decades. MUPTE has been essential to building density in the core.

Since at least 1990, all downtown market-rate housing developments have used MUPTE. The two affordable housing complexes (the Aurora and West Town on 8th) used the 20-year Low Income Rental Housing Property Tax Exemption, in addition to other financing tools specifically available to affordable housing developments.

The last market rate ownership housing (non-student) newly constructed within the downtown MUPTE area was the Tate Condominiums built in 2006. The last market rate rental housing (non-student) newly constructed within the downtown MUPTE area was Broadway Place, built in 1998.

The downtown housing vacancy rate has been at or near zero for many years, but there has been virtually no new construction. This points to some basic economic deficiencies—generally, the cost of new construction is high and the local market rents are too low to support the cost of dense construction.

Local firms have worked to build new housing projects in the city center, but have discontinued their planning. The developer of a proposed mixed-use project at 6th and Oak has put the project on hold, citing uncertainties related to MUPTE. The UO Foundation had proposed to build large amounts of market rate and affordable housing on the riverfront site, but exited the project, citing high risk and low investment returns.

Advertisement