PBCO Financial Corporation Reports Q3 2022 Earnings

PBCO Financial Corporation (OTC PINK: PBCO), the holding company (Company) of People’s Bank of Commerce (Bank), announced today its financial results for the 3rd quarter 2022.

Highlights

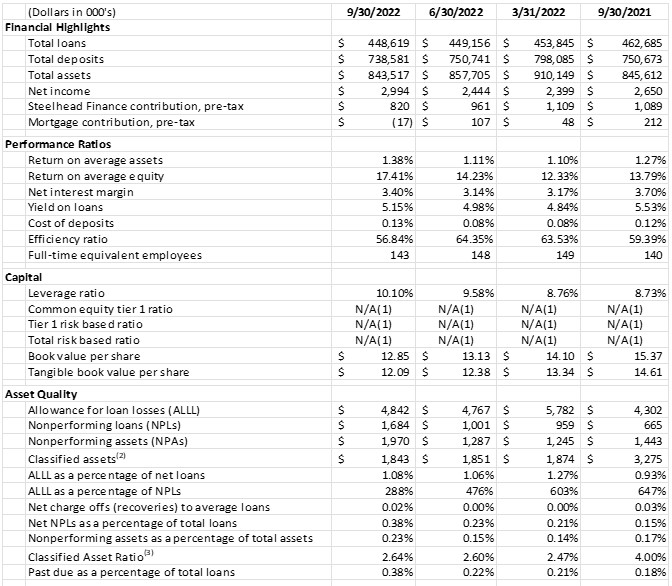

- Third quarter net income of $3.0 million, or $0.59 per diluted share

- Steelhead gross factoring revenue of $1.9 million, a 6.2% increase from Q3 2021

- Core earnings (excluding PPP fee income) up 73.9% from Q3 2021

- Investment securities increased $42.6 million, or 20.9%, over Q3 2021

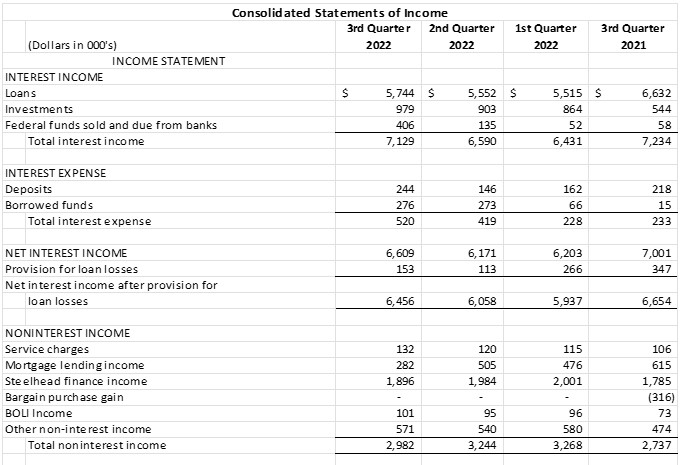

The Company reported quarterly net income of $3.0 million, or $0.59 per diluted share, for the 3rd quarter of 2022 compared to net income of $2.7 million, or $0.53 per diluted share, in the same quarter of 2021. Earnings per share for the trailing 12 months were $2.14 per share, down from $2.28 per share for the prior twelve-month period.

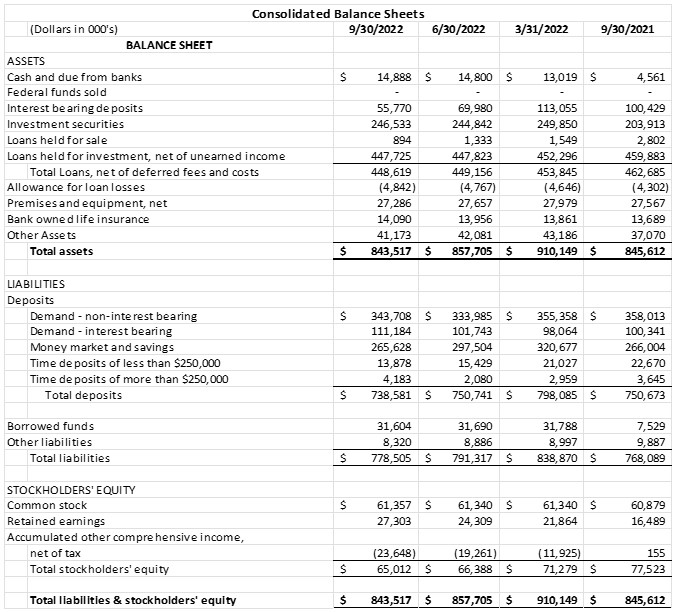

Deposits decreased $12.2 million, a 1.6% decline from the prior quarter ending June 30, 2022. Over the last 12 months, deposits contracted by $12.1 million, also a decline of 1.6%. “During 3rd quarter, the Bank experienced a decrease in deposits as customers sought alternative investments at higher yields on their non-operating cash balances,” commented Joan Reukauf, Chief Operating Officer. “The Bank is in a position where it does not have to aggressively compete for high-cost deposits and some deposit runoff was expected. Although deposits declined during the quarter and year to date, the Bank continues to have excess liquidity available to fund loans and add to the investment portfolio,” added Reukauf.

“Portfolio loans were flat during the 3rd quarter of 2022, compared to 2nd quarter of 2022,” commented Julia Beattie, President. Excluding PPP loans in the portfolio as of 9/30/21, portfolio loans were up $11.4 million from the same quarter, prior year, a 2.6% increase. “Loans have been relatively flat during the year as the Bank made a conscious decision this year not to compete for loans based on historically low rates until the markets stabilize, instead focusing on high quality loan growth,” added Beattie. “These kinds of economic cycles do not favor a high growth strategy – quality and safety tend to win out as consumers and businesses adjust to the new reality.” Future reports will exclude commentary on the PPP program as it is no longer relevant to the financial statement discussion.

The investment portfolio increased $42.6 million or 20.9% from the 3rd quarter of 2021. During the most recent quarter, investments increased $1.7 million from June 30, 2022, or 0.7%, and the average life of the portfolio decreased from 5.0 to 4.6 years. With the steep rise in market rates during 2022, the Bank has limited investment purchases to short-term maturities of less than 2 years. As of September 30, 2022, the gross unrealized loss on the investment portfolio grew to $32.4 million or 11.6% of book value. Securities income was $979 thousand during the quarter, or a yield of 1.5%, versus $903 thousand or a yield of 1.4% for the 2nd quarter of 2022.

Classified assets were up modestly from the prior quarter as total loans past due or on non-accrual increased slightly, as a percentage of total loans, from the prior quarter to 0.38% versus 0.22% as of Q2 2022. During the 3rd quarter, the Allowance for Loan and Lease Losses (ALLL) was updated based on changes in loans and updated economic expectations, which were factored into the Bank’s analysis. As of September 30, 2022, the ALLL was 1.08% of portfolio loans and the unallocated reserve stood at $790 thousand or 16.3% of the ALLL.

Third quarter 2022 non-interest income totaled $3.0 million, an increase of $245 thousand from the 3rd quarter of 2021. During Q3 2022, Steelhead Finance factoring revenue increased $111 thousand, a 6.2% increase over the same quarter of 2021. Conversely, mortgage income decreased $333 thousand, or 54.1%, from the 3rd quarter of 2021, a trend that began with the rising interest rates in Q1 2022. “Today’s mortgage rates, although up significantly from a year ago, are still reasonable when compared to long-term averages,” commented Echo Hutto, SVP and Manager of the Mortgage Division for People’s Bank. “As home purchasers, home sellers and real estate professionals become more comfortable with the new rate cycle, home prices should reflect borrower’s ability to pay and activity should pick up,” added Hutto.

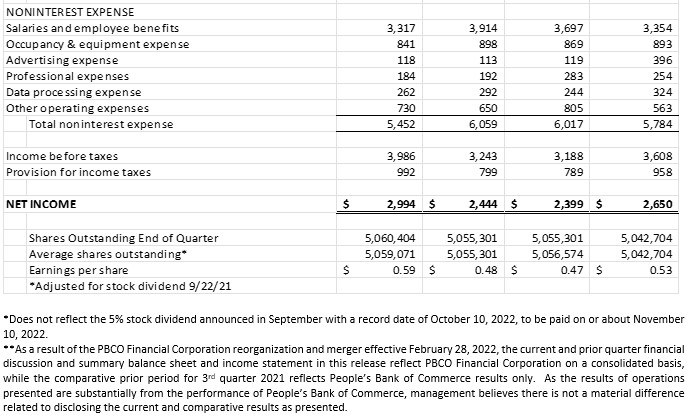

Non-interest expense totaled $5.5 million in the 3rd quarter, down $332 thousand from the same period in 2021. Notably, advertising expenses were the largest driver for the decrease, down $278 thousand in the 3rd quarter of 2022 versus the same period in 2021 when the Bank expensed $250 thousand in donations toward housing relief support for survivors of the 2020 Alameda Fire. Also notable was the decrease in personnel expense of $597 from the prior quarter of 2022. The Bank did not accrue for a quarterly bonus during 3rd quarter as loans and deposits have not tracked with goals established for 2022, the result of the Bank adjusting its strategy to deal with higher interest rates. Salaries and commissions were down $70 thousand and $64 thousand during 3rd quarter, respectively, due to several vacant positions and the slowdown in mortgage production noted above.

As of September 30, 2022, the Tier 1 Capital Ratio for PBCO Financial Corporation was 10.1% with total shareholder equity of $65.0 million. During the quarter, the Company was able to augment capital through earnings while assets also decreased with the decrease in deposits. The Bank’s Tier 1 Capital Ratio was 12.8% at quarter-end, up from 12.7% as of June 30, 2022. The Company also had unrealized losses on its investment portfolio, net of taxes, of $23.6 million, which is attributed to changes in market value in the current rising rate environment. The net unrealized losses in the investment portfolio resulted in the decline in Book Value Per Share and Tangible Book Value per share from prior periods. “Although the unrealized loss in the investment portfolio increased from the prior quarter with the increase in market rates during the same period, the Bank continues to maintain strong liquidity and access to multiple alternative sources of liquidity. The Bank has a very strong capital position that continues to be well above the threshold to be considered well-capitalized,” commented Lindsey Trautman, Chief Financial Officer.

“While the Company’s total assets shrank from the prior quarter, the Company continued to provide solid core earnings, which has allowed the Company to maintain a strong position given the current economic uncertainty,” commented Julia Beattie.

About PBCO Financial Corporation

PBCO Financial Corporation’s stock trades on the over-the-counter market under the symbol PBCO. Additional information about the Company is available in the investor section of the Company’s website.

Founded in 1998, People’s Bank of Commerce is the only locally owned and managed community bank in Southern Oregon. People’s Bank of Commerce is a full-service, commercial bank headquartered in Medford, Oregon with branches in Albany, Medford, Ashland, Central Point, Grants Pass, Jacksonville, Klamath Falls, Lebanon, and Salem.

Advertisement