Housing Affordability in Oregon

By Damon Runberg

The fast growth in home prices have many across the state concerned about housing affordability. Obviously the cost of housing is a critical, if not the most important, component of housing affordability, but it isn’t the only factor that impacts the affordability of housing. In order to better understand affordability trends across the state we need to take into account how much income Oregonians are bringing home and the cost of borrowing.

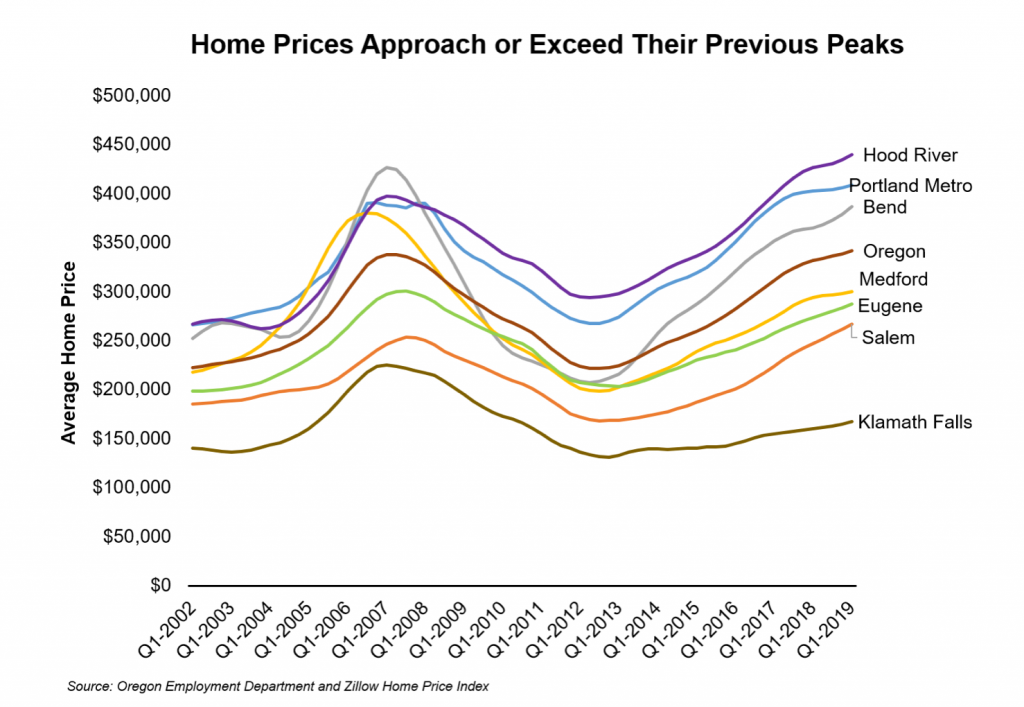

Let’s first take a look at housing price trends across the state. Zillow produces a handy home price index that looks at the average price of all housing types by county. These Zillow estimates reveal that although home price growth has slowed over the past year, home prices are up by a significant margin across most parts of the state over the past five years. Statewide home prices are up around 40 percent since 2014. Some metro areas exceeded that pace of growth. Home prices in the Bend and Salem areas have grown more than 50 percent in the past five years. Home price growth has been more subdued for many rural communities who have struggled in this current economic expansion, such as Klamath Falls in South Central Oregon, where home prices are up around 20 percent over the past five years.

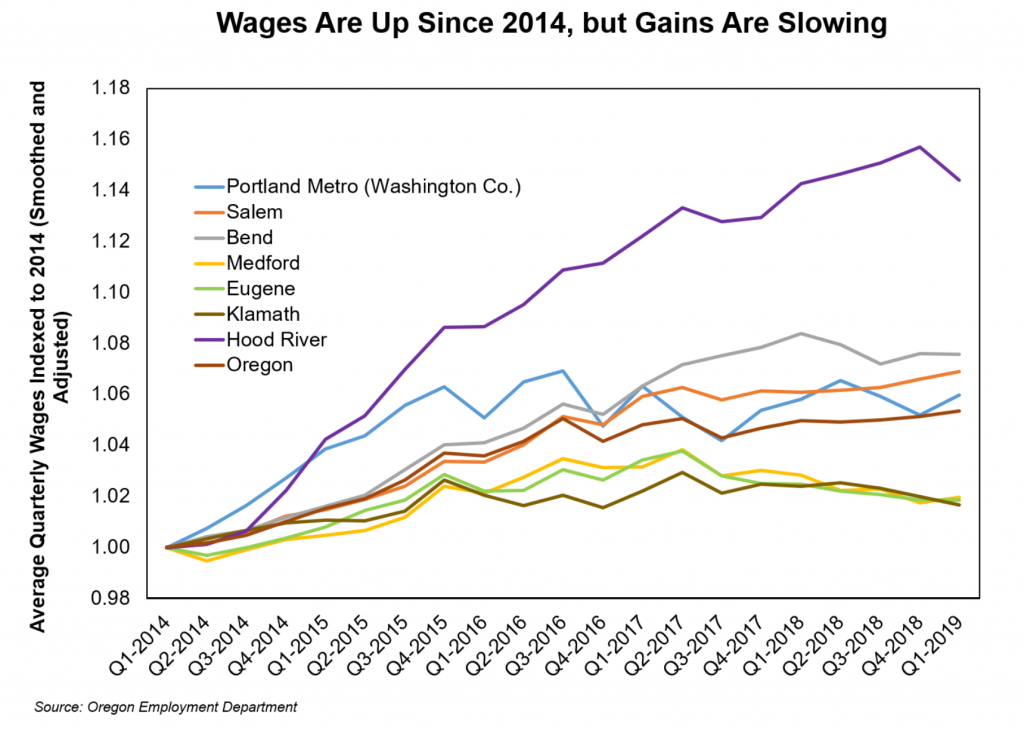

Swiftly increasing home prices have elicited many conversations about housing affordability across the state. But before we call this a housing affordability crisis let’s take a look at the other elements that make up affordability. Outside of home prices themselves, the largest factor affecting affordability is wage growth. How much money you have in your pocket (or bank account) is going to impact how much home you can buy. The good news is that wages are on the rise, or at least they were. The average quarterly wage (smoothed and adjusted for inflation) is up around 5 percent over the past five years in Oregon. To put it another way, after accounting for the changing costs of goods and services, Oregonians are making more money on average than they were in 2014.

All of the different communities highlighted have seen wage gains over the past several years. However, there is a considerable amount of variability among communities. Wages grew quickly in Hood River, Bend, Salem, and Portland. However, wage growth was more subdued in places like Eugene, Medford, and Klamath Falls. Increasing wages should help slow the trend towards housing becoming less affordable.

Finally, the last major variable that impacts housing affordability is the cost of borrowing, or interest rates. Most of us do not have enough cash on hand to buy a home, particularly those of us concerned about affordability. In order to buy a home we need someone to loan us money and the cost of a loan is a significant factor in housing affordability. During the past two years, 30-year fixed mortgage interest rates have been very low. Many consumers have been able to find rates below 4 percent. Back in the last expansion, rates were roughly 2 percentage points higher than they are today. Similar to wages, the low interest rate should help slow the trend towards housing becoming less affordable.

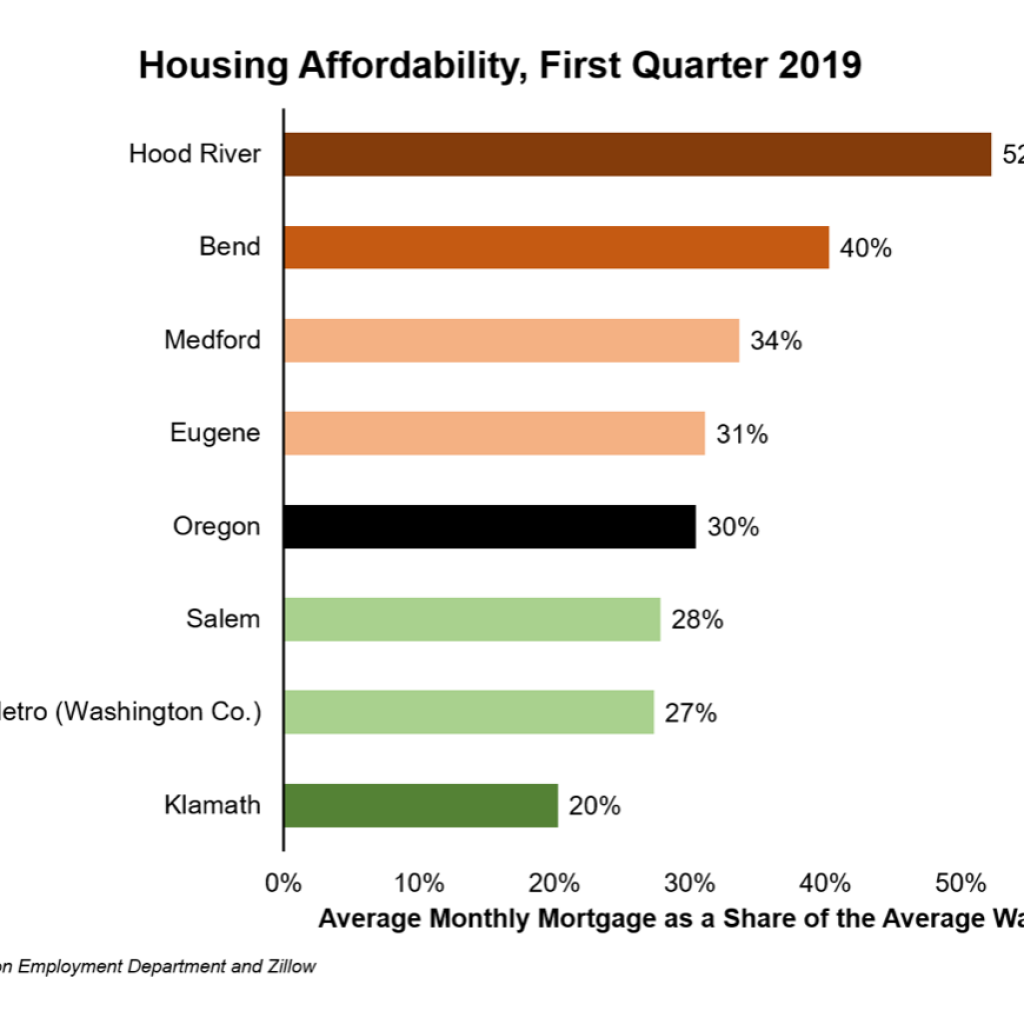

What do we see when these three variables are put together? I developed a housing affordability index that looks at the monthly mortgage of someone with the average wage in a particular geography who bought the average home with the average interest rate. The average monthly mortgage is presented as a share of the average monthly wage for each geography. Across the state, the average monthly mortgage in first quarter 2019 was roughly 30 percent of the average monthly wage.

Affordability varied quite dramatically across the various areas compared. The least affordable was Hood River, where the average monthly mortgage took up more than 50 percent of the average monthly wage. The average monthly wage was more than $1,100 lower than the state, yet the average monthly mortgage was nearly $400 higher than the state. Bend also ranked poorly in housing affordability; the average monthly mortgage was around 40 percent of the average monthly wage. Surprisingly, the

Portland Metro Area (Washington Co.) was generally more affordable than the state as a whole due to high wages that helped to balance the high housing costs. The most affordable community highlighted was Klamath, where the average mortgage was only around 20 percent of the average monthly wage, a relative bargain.

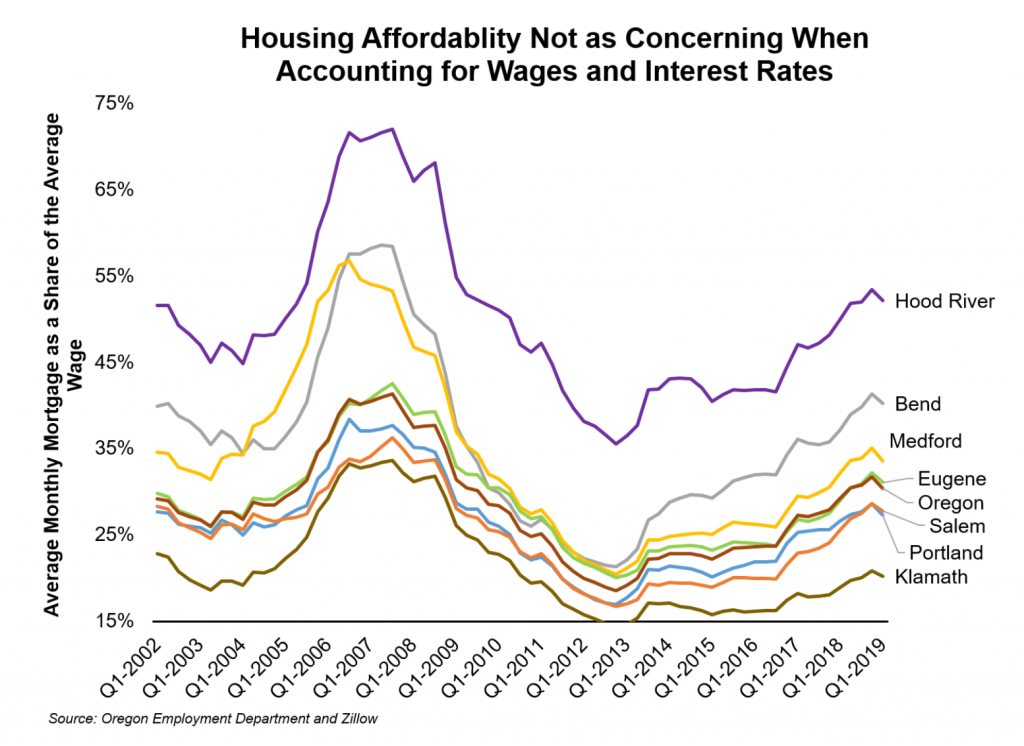

A time-series of this housing affordability measure shows that concerns about affordability may be overstated. The low cost of borrowing alongside recent wage gains have helped to counter, but not completely overcome, the growth in housing prices. Despite the fact that home prices are near or exceeding the peak from the last expansion, affordability remains notably higher than back in the mid-2000s for every community highlighted. The bad news is that every community has been trending toward being less affordable. However, it seems that the trend towards lower affordability is slowing as home price growth decelerates.

Housing affordability is a serious concern across the state and an issue that should be taken seriously. That being said, housing is more affordable today than back in our last expansion, thanks to Oregonians making substantive wage gains in our current expansion and interest rates remaining very low.

Damon Runberg

Regional Economist

Crook, Deschutes, Jefferson, Klamath, and Lake counties

damon.m.runberg@oregon.gov

404 SW Columbia St., Suite 200

Bend, OR 97702

(541) 706-0779

Advertisement